At the end of December 2018, the banking system's assets amounted to BGN 105.6 billion, marking a growth of BGN 7.7 billion (7.3%) year on year and of BGN 2.4 billion (2.3%) for the last quarter alone.

Fibank's assets reached BGN 9.3 billion, an increase of BGN 669 million or 7.7% compared to previous year. Such tendency over the period and in the last quarter was mainly driven by the growth in loans and advances. In 2018, Fibank was among the most active banks in lending to businesses and households.

The corporate loan portfolio of the bank increased by BGN 457.7 million or 11.4% YOY, while the average annual growth for the banking system was 5.2%. For the last quarter alone new business loans increased by BGN 198.4 million, placing the bank in a leading position by this indicator for the period under review.

Among the milestones in Fibank's business lending over the last year was the launch of the Smart Lady program, aimed at stimulating female entrepreneurs. It features not only lending opportunities tailored for business ladies, but also a range of other financial and non-financial solutions offering them support and security.

2018 also witnessed a significant recovery in household lending. The total increase in that sector was BGN 2.3 billion (11.6%) over the year. Fibank's mortgage loan portfolio grew by 20.5% for the period, against an average system growth of 15.3%. At the same time, the bank preserved its stable position in the consumer lending segment where it reported a growth of 7.7%.

Deposits in the banking system grew by BGN 6.0 billion (7.2%), to BGN 89.7 billion over the year. Growth was reported in deposits of households (by BGN 3.9 billion, or 7.9%), and of non-financial corporations (by BGN 1.1 billion, or 4.5%). In the fourth quarter of 2018 there was an increase in both the total amount of deposits and in those of households.

In 2018, Fibank retained its leading position as one of the preferred savings banks of the population. The total deposits from individuals increased by BGN 317.8 million over the year.

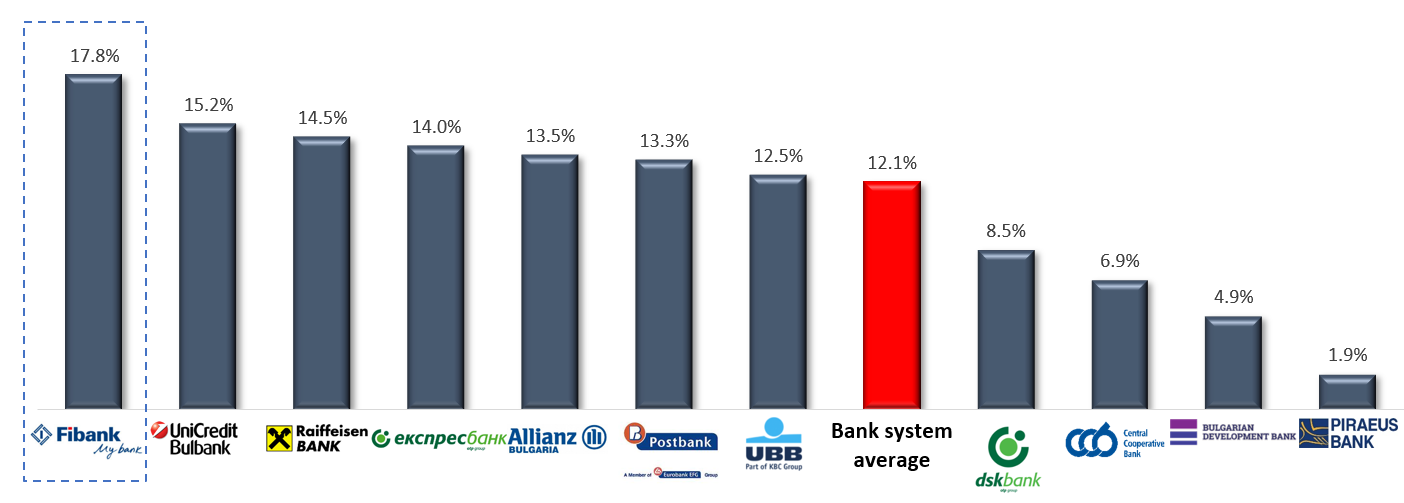

The Bank ended the year with a profit growth of 83.3%, reporting an increase in interest income. The bottom line was also driven by the income from sale of assets, which contributed BGN 75.1 million in the last quarter. Thus, Fibank reported the highest return in equity among leading banks in the country: 17.8% against an average for the banking system of 12.1%.

Return on Equity (Non-Consolidated) as of Dec. 31, 2018

Source: BNB

2018 brought Fibank several international awards. The Bank was among the winners in the Innovation category of the Efma-Accenture DMI Awards 2018, which brings together some of the world's most renowned institutions and companies in the retail segment. The prize was awarded to Fibank as recognition for its innovation in the Bulgarian market: a microchip for children and teen debit cards, as well as for the Bank's early financial education program. The launching communication campaign of Fibank’s Smart Lady business program also won a prestigious award at the European Excellence Awards 2018 in Dublin.

Mrs. Maya Georgieva, Deputy Chair of the Supervisory Board of Fibank, received the Banker of the Year Award for her overall contribution to the development of the banking system and for the sound management of market risk challenges in the largest Bulgarian-owned bank.

In 2018, Bulgaria embarked on the road to Bulgaria's accession to the eurozone. "This will increase the confidence in banks and will probably improve their ratings by giving them access to better financing terms. The fact that the ECB will oversee the systemically significant banks in Bulgaria will create a higher degree of confidence in the general public, the customers and partners of banks," Mr. Nedelcho Nedelchev, CEO and Chairman of the Management Board of Fibank commented for Euronews.

Коментари