Fibank will present innovative products and services tailored to the customer and based on high-tech solutions

In the beginning of 2020, Mr. Nikola Bakalov joined the Fibank management team as a member of the Management Board and Executive Director. Mr. Bakalov is responsible for the following departments: Retail Banking, Cash Office, Digital Banking, Gold and Numismatics, Card Payments, Branch Network, Organization and Control of Customer Service, and Private Banking..

- Bakalov, how do you see your priorities as member of the Management Board of the largest Bulgarian-owned bank?

First Investment Bank has always been a leader in electronic payments. The bank is associated with excellent customer service and good product offers. We have been able to quickly implement the best banking practices known in Europe, tailoring them to the Bulgarian specifics and meeting the needs of our customers. This is not an easy task when you work in a dynamic environment, with fintech companies emerging and offering new ways of managing personal finances. This is where I see my main priorities: to continue and reinforce the existing perception of customers that Fibank offers the best service, coupled with innovative technologies and products.

First Investment Bank has always been a leader in electronic payments. The bank is associated with excellent customer service and good product offers. We have been able to quickly implement the best banking practices known in Europe, tailoring them to the Bulgarian specifics and meeting the needs of our customers. This is not an easy task when you work in a dynamic environment, with fintech companies emerging and offering new ways of managing personal finances. This is where I see my main priorities: to continue and reinforce the existing perception of customers that Fibank offers the best service, coupled with innovative technologies and products.

This is a serious challenge, but I believe our team will achieve the best results possible. In addition, we have the attitude and guidance of the Bank's senior management, which is fully supportive of such development. These are the two prerequisites for the fulfilment of our ultimate goal, which is delivering satisfaction to our customers.

- Speaking of fintech companies, there has been much talk recently about their rapid entry into the financial market. In your opinion, how will the sector develop?

In my view, the best outcome for the customer experience lies in cooperation, in banks and fintech companies finding their optimal synergy. Fintech companies are less regulated and have flexibility. Banks, on the other hand, are institutions with a long history, large resource and a huge customer base that has entrusted them with their savings. It is great that fintech companies exist, because they contribute to the technological development of the financial sector. Ultimately, the customer wins in means of convenience, security and speed.

- Perhaps one of the strengths of banks is the human factor: the personal service customers receive in banking offices. In this regard, how do you see in the development of two of your business lines: Branch Network and Customer Service?

Here, we need to look at two processes that go hand in hand and affect the branch network and customer service, namely: digitalization and bank consolidation.

Digitization inevitably brings some of the standard banking operations out of the office. In time, banking offices will turn into a place for receiving expert advice from well-trained officers, while day-to-day transactions will disappear completely. Customers will be able to do just about anything online, from anywhere in the world. On the other hand, banks are consolidating. We have been observing this process in Bulgaria for years, and with consolidation comes reduction in the number of offices.

At Fibank, we believe in remaining close to our customers. In the long run, employees' efforts will not be devoted to routine operations. Most likely, many of them will retrain by upgrading their competencies.

- In terms of digital banking, what are your plans for 2020?

We are working on the continuous expansion of services and options that we offer to our customers, while meeting all regulatory requirements and complying with the highest security standards.

We are working on the continuous expansion of services and options that we offer to our customers, while meeting all regulatory requirements and complying with the highest security standards.

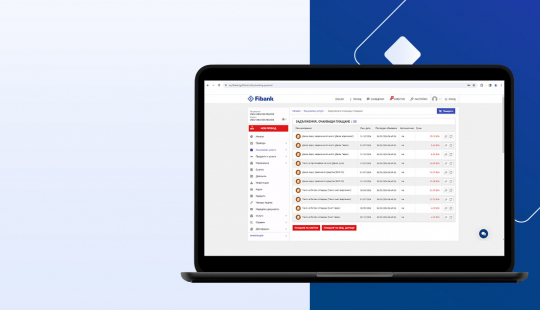

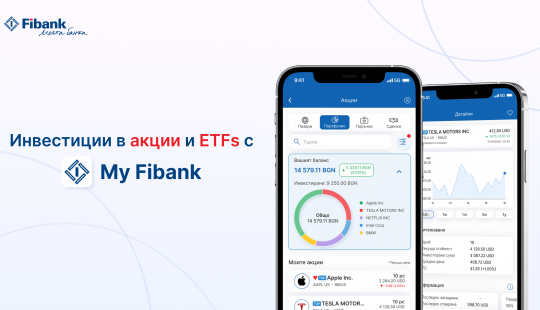

At the end of 2019, Fibank launched the first open banking platform in the country, entirely based on the PSD2 directive. Currently, accounts in 2 more banks operating in the Bulgarian market can be added in our mobile app and this number is about to increase. Using a smartphone, our customers will be able to operate with their accounts at various leading banks, taking advantage of the extensive range of features offered by My Fibank. Very soon, "open banking" will also be accessible via computer.

In January, we added to our mobile app active banking for legal entities. Thanks to it, companies may now carry out their routine banking transactions using only a smartphone, thus saving valuable time and resources.

We are currently developing a number of new in-app card management solutions. In 2020 we will also provide the option for online applications for the issuance and activation of debit cards.

- The name of First Investment Bank is synonymous with innovations in digital banking and card payments. What's next in the field of cards?

In line with Fibank's pioneering spirit in card payments, in 2020 we will present to our customers a number of interesting offers, as well as introduce 2 brand new card products.

We started 2020 with a very strong product: the first Visa cards with a design dedicated to the Tokyo 2020 Olympic Games. Soon, customers will be able to digitize their Visa cards and add them to their Apple wallet.

I would like to remind that in back 2010, in partnership with Mastercard, we offered the first contactless cards on the Bulgarian market, in 2016 - the first digital cards based on NFC technology, and in 2019 were again the first in Bulgaria to launch Apple Pay and Garmin Pay services using Mastercard digitized cards.

- Fibank offers the Private Banking service through one of the departments you are responsible for. What are the trends for development in 2020 in this regard?

The activities of the Private Banking department cover two main segments: Private Banking (high customer segment) and Personal Banking (affluent segment). In view of the increased financial wealth of Bulgarians and their fast-paced daily life, we offer an exclusive product in the spirit of excellent customer service and best European practices. In 2020, I anticipate an increase in both segments, including 7-9% in Private Banking, and over 100% in Personal Banking customers.

- In 2019, Fibank consolidated its position as one of the preferred consumer and mortgage lending banks. The question that undoubtedly concerns customers is whether loan interest rates will remain low. What are your forecasts?

In 2019, Fibank's consumer loan portfolio grew by 10.3%, and that of residential loans by 18.5% year-over-year. Currently, interest rates on loans are extremely low. My mid- to long-term forecast is that they will remain at these levels. There are several processes running simultaneously which have a mixed impact on interest rates. We will have to wait and see what happens.

- The confidence of Bulgarian consumers in the banking system remains high, which is evidenced by the fact that Bulgarians prefer to keep their savings in a bank. How would you comment on this trend?

First Investment Bank has established itself as one of the preferred financial institutions for business and household savings. A bank deposit is a savings haven without an alternative, where the factors of trust and security are paramount. I believe that the tendency of Bulgarians placing their trust in banks will continue. Bulgarians have always been prudent in their finances: they set savings aside do not succumb to unreasonable spending.

- Speaking of savings and investment, we are seeing a steady increase in the price of gold. What lies ahead for the Gold and Numismatics department?

The upward trend in precious metal prices against the backdrop of dynamic political and social events around the world contributes to the glitter of gold and its high investment value. Investors, collectors, numismatists and customers looking for a stylish gift recognize Fibank as a trusted partner. We are distinguished by having our own conceptual designs and investment products, by offering bars, pendants and coins of the most reputable international manufacturers, as well as by being the largest distributor of Bulgarian commemorative coins.

We will be offering a number of new products in 2020. In the spring we will present a gold coin with the image of St. George, one of the most revered orthodox saints in Bulgaria. In the spirit of digitalization, we will also continue to develop our online store Fibank Gold and Silver.

- What factors will be driving the development of the banking sector in 2020? What are your forecasts in the short and long term, say up to 5 years?

2020 will be influenced by many factors related to the implementation of technological innovations. The intensity and pace of work are increasing, which is good for customers because they are getting newer and better services. The policy of low interest rates will continue, as well as the consolidation process.

In the long run, I expect almost all transactions to be carried remotely, by means of devices. Payments and transfer of funds between individuals, businesses and institutions will run naturally and seamlessly. Banking offices will become a place for customers to receive advice from well-trained experts. I envisage expansion in the range of products and services offered on site, including the entire range of financial market services, and probably other technological solutions not yet typical for today's banking office.

Коментари